Why CoinLedger Is a Game-Changer for Crypto Tax Reporting

As cryptocurrency adoption continues to grow, so does the complexity of crypto tax reporting. From trading on multiple exchanges to earning income through staking and DeFi protocols, today’s investors face a web of transactions that can be difficult to track and report accurately.

CoinLedger was built to solve this exact problem — offering a streamlined, secure, and efficient way to manage crypto taxes without the stress.

The Reality of Crypto Taxes

Unlike traditional investments, crypto activity often spans various platforms, wallets, and blockchains. Each transaction — whether it’s a simple trade or a complex liquidity pool interaction — may have tax implications.

Investors commonly struggle with:

- Consolidating data from multiple exchanges

- Tracking cost basis correctly

- Calculating short-term vs. long-term gains

- Reporting staking, mining, and airdrop income

- Managing NFT purchase and sale records

Manually organizing this information can take hours — or even days — especially during tax season.

How CoinLedger Simplifies the Process

CoinLedger transforms complicated transaction histories into clean, accurate tax reports in just a few steps.

Step 1: Import Your Transactions

Users can connect their exchanges and wallets using secure API keys or upload CSV files. CoinLedger supports a wide range of platforms, allowing you to sync your entire crypto activity into one dashboard.

No more spreadsheets. No more guesswork.

Step 2: Automatic Calculations

Once your data is imported, CoinLedger automatically calculates:

- Capital gains and losses

- Crypto income

- Cost basis across multiple platforms

- Holding periods for tax classification

The software supports various accounting methods like FIFO, LIFO, and HIFO to match your tax strategy.

Step 3: Generate Tax Reports

With a few clicks, CoinLedger generates IRS-ready reports such as:

- Form 8949

- Schedule D summaries

- Income reports for staking and mining

These files can be directly uploaded into tax filing software or shared with a tax professional.

Built for Modern Crypto Investors

Crypto is constantly evolving — and so are transaction types. CoinLedger supports:

- DeFi token swaps

- Yield farming rewards

- Liquidity pool transactions

- NFT trades

- Airdrops and staking rewards

The system intelligently categorizes these transactions to ensure compliance and accuracy.

Designed for Both Beginners and Experts

Whether you made 20 trades or 20,000, CoinLedger adapts to your needs. The intuitive dashboard provides:

- A real-time overview of gains and losses

- Error detection tools

- Tax liability estimates

- Clear transaction breakdowns

Even first-time filers can confidently manage their crypto taxes.

Security and Peace of Mind

CoinLedger uses secure, encrypted connections and read-only access to ensure your assets remain safe. The platform cannot execute trades or withdraw funds — it only imports transaction data.

Your financial security is always a priority.

A Smarter Way to Handle Crypto Taxes

Crypto investing should be about opportunity — not paperwork. CoinLedger eliminates the stress of manual tracking and complex calculations, giving you clarity and control during tax season.

Instead of scrambling to reconcile transactions at the last minute, you can stay organized year-round and file with confidence.

If you're looking for a reliable solution to simplify crypto tax reporting, CoinLedger offers the tools you need to stay compliant and focused on what matters most — growing your portfolio.

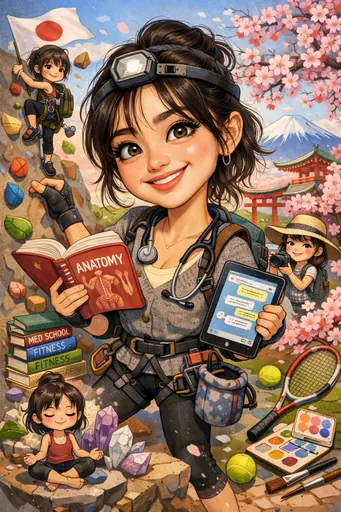

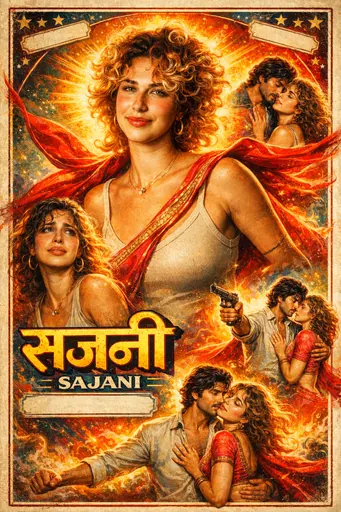

Create your first image

Got an idea? Try one of our new curated styles and filters or imagine something from scratch.

Try now

Caricature Trend

Camcorder

Neon fantasy

Norman Rockwell

Iconic

Post-rain sunset

Flower petals

Gold

Crayon

Paparazzi

Clouds

Department photoshoot

Minimalist

Kalighat

Chikankari

Rajasthani textile

Iridescent metal portrait

Bollywood poster

Festival

Mithila

Jaipur textile

Sari landscape

Desi outfit

Sketch

Dramatic

Plushie

Retro anime

Baseball bobblehead

Doodle

3D glam doll

Sugar cookie

Fisheye

Inkwork

Pop art

Ornament

Art school